The hype around impending 5G wireless rollouts could place the reader into one of two camps. The realist camp may say 5G wireless is just like the first generation of broadband services in the early part of the century. There is great hype around the endless possibilities afforded by high-speed Internet, but without tangible ‘killer apps’ to drive adoption, it’s unclear how to justify the massive investment. Deloitte Consulting estimates that fiber infrastructure investment of $130B to $150B will be required to build out 5G across the United States over five to seven years—let alone the rest of the world.

Visionaries may state that 5G will offer access to new applications like artificial intelligence and smart city infrastructure that could define the next industrial revolution. Companies and countries failing to act now will find themselves left behind global and regional powers that are indeed investing in 5G. As we navigate the post-COVID 19 world, we are finding that economic and social survival is tied to the ability to work and play at a distance. If ever there was a time for a revolutionary new Internet technology to take hold, now would seem to be it.

Wireless backhaul services have evolved to grow the size of the data pipe to mobile sites from copper TDM (time-division multiplexing) circuits delivered to multiple lit 1G or 10G Ethernet services over fiber for 4G LTE. Traditional backhaul has developed into a patchwork of mobile provider owned-and-operated fiber to leased dark fiber and lit fiber services. Wholesale backhaul services in the 4G and earlier environment were simple and straightforward. A backhaul provider could drop a 24-core or 48-core fiber or a WDM (wavelength division multiplexing) trunk at a mobile site and be assured of the fiber capacity for current and future data needs. Over time, service providers of all sizes have relied upon backhaul services as a source of revenue and a means to see new fiber builds.

Market disruption

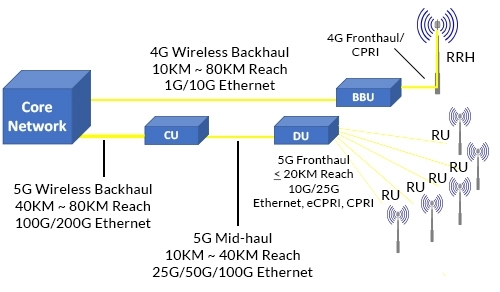

5G wireless presents a radical new architecture heavily dependent upon a fiber-optic infrastructure, as fiber will be required in areas closer to the user where in-ground fiber may not yet exist. 5G wireless introduces the virtualization and disaggregation of the BBU (baseband unit) and RRH (remote radio head) functions across multiple network elements (cleverly titled the CU for Central Unit, DU for Distribution Unit, and RU for Radio Unit). These network elements pool the resources for multiple radio units into one DU and CU unit (whereas 1 BBU per radio site is used for 4G). Distributing these resources into the outside plant results in 5G “x-Haul” architecture with potential market disruptions and/or opportunities for backhaul service providers. Major wireless service providers have been preparing for the fundamental change in the fiber infrastructure by investing heavily in local fiber access by both organic and inorganic means.

Figure 1 (above) contrasts the largely point-to-point traditional wireless backhaul, possibly on a fiber ring or on a single fiber run with 5G’s distributed architecture, against 5G x-Haul. 5G’s x-Haul architecture will aggregate data from multiple radios to DU and CU elements at significantly higher data rates than earlier generations. The fiber infrastructure required to aggregate 5G’s massive data requirements is central to the “new backhaul economy.” A new calculus will be required to account for the location of fiber assets, the bandwidth availability and service levels to drive 5G deployments.

Location of fiber assets

The availability of fronthaul fiber access will be the single largest market problem in deploying 5G. The frequency ranges 5G of sub-6GHz and millimeter-wave (>24.25GHz) offer potentially staggering bandwidth services (20Gb/s downstream, 10Gb/s upstream), with the drawback of substantially shorter reach than 4G (often at line-of-site ranges). One 4G tower often covers several square miles, in comparison to shorter-range millimeter-wave antennas that will be spaced approximately every 300 meters to provide a blanket of up to roughly sixty small cells per square mile, with each small cell potentially requiring up to six fibers! (see Figure 2) Even regions with high population density, including city centers and other areas where fiber may be present, will have difficulties offering this massive fiber density.

Bandwidth availability

5G enhanced mobile broadband achieves landline-like data rates but also requires the pipes feeding the network to be supersized. This starts at the radio head, with 10Gb/s and 25Gb/s fiber optic transceivers installed, with the midhaul aggregating to 25Gb/s to 100Gb/s connections to up to 100Gb/s in the backhaul. (See Figure 1)

The value proposition of 5G to wireless service providers goes well beyond enhanced mobile broadband services, layering network slices to support new service offerings. Internet of Things, smart energy, smart agriculture, and critical performance applications such as driverless cars are a few of the many applications for 5G technology. The supporting 5G x-Haul architecture will require not only significant bandwidth upgrades in backhaul transport links but in the distribution (midhaul) and access (fronthaul) network segments.

Service levels

Mobile services have developed from ‘best effort’ to viable alternatives to landline voice and data services. The low-latency and highly available applications driving 5G will drive wholesale services to another level. Driverless cars and manufacturing machine-to-machine (M2M) communication will require service levels beyond traditional cellular communications. Additionally, the rumors of 4G’s demise are greatly exaggerated: 4G services will continue to be offered and will coexist with new 5G services.

Solutions for the new backhaul economy

The participants in the new backhaul economy will be those positioned to capitalize on the disruptions 5G x-Haul will present to the market. Participants may vary between traditional service providers, with utilities and local governments who have both fiber assets and business requirements for 5G services.

Sheer volume

Access to fiber in the fronthaul will be the single largest expense in deploying 5G. The sheer volume of fibers required to blanket a service area will require solutions to utilize existing fiber infrastructure to reduce the capital expense of the fiber build.

WDM (wavelength division multiplexing) expands the capacity of a fiber pair by up to 96 times over standard ‘gray’ optics by combining multiple signals at different wavelengths over a single fiber pair. WDM technology is proven in core and distribution networks and is now extended into the access network of 5G. Recent innovations in auto-tunable dense wavelength division multiplexing (DWDM) technology promise to drive down the cost of 5G fiber deployment by reducing labor and inventory costs for new services. Installation crews can simply install an auto-tunable optic without regard for matching up wavelengths with multiplexer ports or transceivers on the other end.

Longer-term next-generation 25G or 50G passive optical networking (PON) technologies may offer a fit for extreme bandwidth requirements over existing residential or commercial PON networks.

Bandwidth availability

5G backhaul and midhaul services will require solving the network problem of offering 100Gb/s Ethernet beyond 40 km at low cost and without amplification. Today this problem is addressed through higher-cost coherent optics or with open line systems, providing amplification and dispersion compensation.

The 80 km QSFP28 ZR4 is on the horizon, which will finally solve this glaring network need. Not only will this transceiver connect 100G over 80 km, but it also does so without the support of external amplification and in the cost-effective QSFP28 transceiver package.

Service levels

Service level agreements for 5G x-Haul services will be no less strict than previous generation services. Offering highly available low-latency services will be challenged by the intended deployment environment. The fiber optic endpoint transceivers will be installed in neighborhoods, light poles, utility poles, and even traffic lights! These are environments far from hospitable for standard fiber optic components. Standard fiber optic transceivers with operating temperatures of 0°C to +70°C are designed for use in climate-controlled central office or hub facilities. This condition is especially true for WDM transceivers. Standard WDM transceivers can fail outside of climate-controlled environments due to wavelength drift that may cause the wavelength to not pass through a mux—potentially interrupting service.

Careful attention to temperature ratings on transceivers is necessary to fulfill service level agreements. The networking equipment industry recognizes three operating temperature envelopes for transceivers: 0°C to +70°C or standard temperature, industrial temperature (ITEMP) -40°C to +85°C, and extended temperature, which does not indicate any specific range, only that the range is greater than commercial temp, but not to ITEMP requirements. Transceivers in the extended range will attempt to pass themselves off as ‘hardened’ but in reality, their components have not been tested to operate in harsh extremes.

Conclusion

The new backhaul economy is poised to disrupt the traditional wireless backhaul ecosystem built for previous wireless generations. Success in this new economy will be driven by participants that adapt rapidly to solve the challenges of offering 5G x-Haul services.